Rent to Value: An Easy Trick to Spot a Good (or Bad) Investment

I recently got back from a family vacation in Florida and a real estate field trip in Dallas. Though it was a fun adventure, it’s good to be home in sunny Southern California. It's nice to step outside without immediately turning into the consistency of a caramel apple or being attacked by a thousand gnats. Oh, and daycare is also pretty great.

While traveling to visit real estate is usually a fun adventure, it's obviously not as easy as investing close to where you live. Do I want to fly to Utah for a day to fix a roof? Not exactly.

It’s no wonder that every now and then I ask myself, “why don’t we just invest where we live, here in sunny Southern California?”

Blue Skies and Bad Math

Since I do have an 11 month old, I thought I'd make a little nursery rhyme to start things off here to describe my thoughts on investing in southern California:

The beaches may be beautiful and the skies may be blue but when it comes to real estate investing, the numbers won't work for you. - A Kimbro Original

Now there are obviously billionaires and super-duper-billionaires who made their billions off of California real estate and overpriced cupcake companies, but that’s not the norm.

For the average Joe or above average Joe like you and me, the numbers just don’t make sense. You can’t put lipstick on an unprofitable pig, no matter how good it looks in short shorts.

Southern California isn’t alone. There’s lots of places where the numbers don’t make sense. How can you quickly spot a good area from a bad? Well besides the gnat to human ratio, there’s a quick and easy calculation. Let's start with an example ...

Let’s Buy a House and Rent it Out, Honey!

Let’s say you decide to buy a home in SoCal to rent it out for a little extra monthly nut.

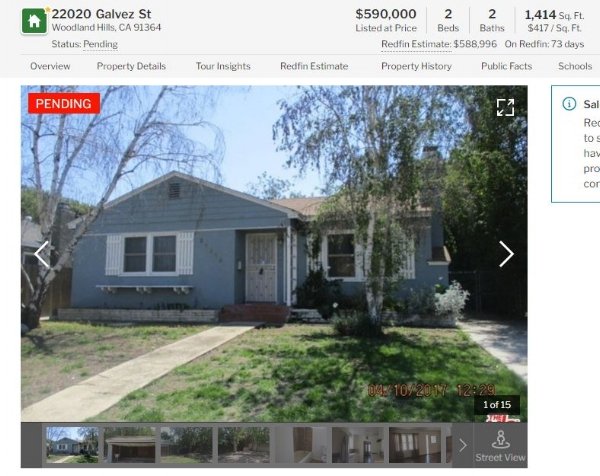

Here’s a little gem I found while searching for houses in Woodland Hills, California, a suburb of Los Angeles in the San Fernando Valley:

It was the least expensive house listed, with the following specs:

Address: 22020 Galvez St

Price: $590,000

2 bed/ 2 bathroom

1,400 Squarefeet

Year Built: approximately when Columbus discovered America

How Much Can We Make

So how much can you rent this little puppy out for? Doing a quick search for rentals of the same size and same area, it seems the typical going rental rate is $2,600/month. This is on the generous side because all the rentals I found were 3 bedrooms instead of 2.

This gives us annual income of:

INCOME = $2,600 / month x 12 months = $31,200 / year

Not too shabby … or is it?

How Much Does it Cost

There are lots of expenses in renting a place - repair and maintenance, utilities, and property management if you’re outsourcing it, just to name a few. And this spring chicken probably needs some work from the outset. But before we even dig into those expenses, let’s look at just the cost of purchasing it.

Here’s a quick loan calculation.

INPUTS:

Price: $590,000

Down Payment of 10%: $59,000

Interest Rate: 4.2%

Term: 30 Year Fixed Rate

Note that down payments on a home typically vary from 5-20% so I chose 10%. Interest rates can vary over time obviously, but currently in 2017, 4.2% is a good estimate.

Plugging the inputs into your favorite loan calculator give the following payments:

OUTPUTS:

Monthly payments (principal + interest): $2,597

Monthly Taxes: $256

Monthly Insurance: $67

Monthly PMI (insurance for mortgage): $261

TOTAL: $3,180 / month

Note that the taxes may be higher than what the calculator spits out depending on the exact location/county of the property.

So to just purchase the place and pay the required property tax will cost us annually:

LOAN & TAXES EXPENSE = $3,180/month x 12 months = $38,160 / year

Before we even get into any of the other expenses, let's just take a quick look at where we stand ...

PROFIT = INCOME - EXPENSE:

INCOME = $31,200 / year

LOAN & TAXES EXPENSE = $38,160 / year

OTHER EXPENSES = Who cares!?!?!

Houston, we have a problem. Not taking into account any of the other expenses (which are not insignificant by the way) this little eyesore is putting us in the hole from DAY ONE!

So what’s really going on here and how can you quickly figure this out for any property or region you’re considering investing in?

Rent to Value Ratio

The rent-to-value ratio is a concept that I believe was originally defined by Jason Hartman of Hartman Properties. (A great company to consider if you want to get into turnkey investing into single family homes).

RENT-TO-VALUE RATIO

A percent defined as the monthly expected rent for a property divided by purchase price of the property.

The higher the rent to value ratio, the better an investment. An ideal rent to value ratio is 0.7%, and 1% or higher is excellent.

The term comes from the price-to-rent ratio which is the overall ratio of home prices to annual rental rates in an area and is used to advise residents if they'd be better off renting or buying a home.

A higher price-to-rent ratio means it’s a better area for renters. Therefore, it’s basically the opposite of the rent-to-value ratio. After all, if it’s cheaper to rent than to buy, it’s probably not going to be a good place to invest. Here’s a list of the top 10 cities with the highest price-to-rent ratio:

For the full ranking of every U.S. city with population over 250k, click here.

As you can see, Los Angeles has the honor of being 4th on the list, and therefore some might say the 4th worst place to invest for us above average Joe's, especially in single family homes.

Back to Our Bungalow of Pain

So what’s the rent-to-value ratio in our example property?

We estimated the rent to be $2,600 per month and the purchase price was $590,000. That gives us:

RENT TO VALUE RATIO = $2,600 / $590,000 = 0.004 = 0.4%

So the rent to value ratio on our property is 0.4%, which is significantly less than the targeted 0.7%. How much less? Well, to hit 0.7% in rent-to-value, you would need to charge $4,130 instead of $2,600 in monthly rent. I’m pretty good at sales, but even I don’t have enough lipstick for that pig. More gnats please.

Enjoy reading? Check out the first and second steps to your financial freedom, and make sure to sign up to receive weekly updates.